Infrastructure PR

Little Relief For Consulting Engineering Industry In SONA 2023, Highlights AECOM

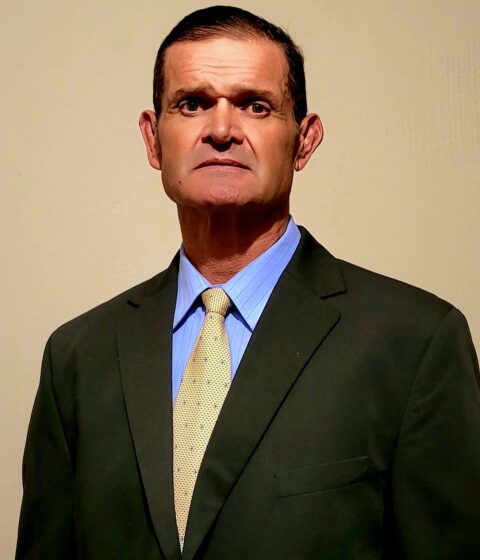

South Africa urgently needs to accelerate its infrastructure project pipeline and ensure sufficient technical capacity at the municipal level. This is the message from Darrin Green, Africa MD of globally trusted infrastructure firm AECOM. While President Cyril Ramaphosa highlighted various infrastructure projects that have finally entered construction stage in his State of the Nation Address on 9 February, “we are not seeing anything new for the consulting engineering industry.”

Green argues that the procurement process for public sector work remains “fraught with difficulty and is enormously difficult and cumbersome.” In addition, there is the issue of a dearth of technical capacity at the municipal level. In terms of water infrastructure, a lack of maintenance has resulted in a water loss of over 50% at some municipalities at present. “What is the point of adding new capacity and supply when the existing infrastructure is not being looked after?” questions Green.

A related issue is who ultimately pays for these water losses. “We have fundamental grassroots problems that need to be resolved first. It calls for a much bigger focus on the municipal level in terms of asset management, maintenance, and refurbishment,” argues Green. While there is a welcome renewed focus on project preparation, such funding must be spent effectively for maximum impact. Green says the lack of in-house capability means that municipalities should ideally reach out to private sector institutions like Consulting Engineers South Africa (CESA) and the Engineering Council of South Africa (ECSA).

Looking at the tender process itself, Green notes “there is too much emphasis on compliance.” The process could easily be streamlined by establishing an in-house database. “The discounting imposed on bidding and the cost of tendering is so high as to not make it worthwhile to do so in many cases, while the project cost is driven so low, we are unable to carry out the work effectively.”

This impacts the quality of successful projects. “In terms of procurement, there must be a much bigger emphasis on quality from a consulting engineering and contracting perspective. We must consider the total lifecycle cost of projects, not just the small part of the budget spent upfront on design and construction monitoring,” argues Green. If this is done correctly, it will drive construction and lifecycle costs down. “That is simply not being taken into account.”

Quality therefore needs to be a strong element of the bidding process. “We may have lofty ideas, but the procurement process is so protracted that it does not have the desired outcome.” While it is not ideal to harness private-sector funding for public sector projects, so-called Public-Private Partnerships (PPPs) have in the recent past been touted as the panacea to expedite projects and attract funding. However, if the correct project preparation is not in place from the outset, the viability of such projects becomes questionable.

“Much more thought must be given to streamline procurement and emphasise the importance of quality and using the right skills. While the skills are still here, we are rapidly losing our young engineers. There is just not enough work coming through. We as an industry and a profession have paid for and heavily subsidised that training. As a business, we have put five to six years into those professionals post-graduation to get them registered, but they just do not see a future. We need to act now to utilise the skills and capacity still available in the country to address our infrastructure backlog,” points out Green.

Looking at potential new economic sectors as the country embarks on its Just Energy Transition, Green says that AECOM is a global leader in emerging sectors such as green hydrogen and e-mobility. “While we may not have all the specific expertise locally, we have access to it internationally. It places us at a tremendous advantage and presents a huge opportunity for us going forward.”

When it comes to renewables, the rollout of the next bid windows of the Renewable Independent Power Producer Programme (REIPPP) has been very slow. While the latest phase has been approved, its delay means that finalisation and implementation are likely to take considerable time. “We are certainly well positioned to provide the necessary infrastructure to accompany renewable projects,” adds Green. However, he cautions that the pricing, especially around wind farm projects, has become particularly “cutthroat”, driving down margins and stalling projects from getting off the ground.

While Infrastructure South Africa was established to accelerate investment and fast-track priority infrastructure projects, it has yet to produce a viable pipeline. “Sourcing investment funding has proven relatively successful, but project preparation and rollout have been major stumbling blocks.” Green says many of the projects referenced in SONA 2023 have been in the pipeline for some time and therefore are not new initiatives.

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.