SA Mining

South Africa’s Energy Outlook For 2021

As we sit poised at a juncture of history in which there is a global shift towards cleaner energy, South Africa’s mineral and energy complex must carefully balance the country’s traditional reliance on coal-based energy on the one hand with the bold commitments towards renewables as outlined in the 2019 Integrated Resource Plan (IRP) on the other.

The plan, which drives policy around energy, envisions some drastic shifts in the energy space in the next 10 years. Coal, which currently accounts for 85% of SA’s electricity generation, will account for just 59% by 2030. Solar energy will constitute 18% and wind-harnessed power 8%, bringing the total for renewables’ contribution close to 25%.

Coal

For the foreseeable future however, coal will remain the most crucial resource in the energy mix for a variety of strategic reasons. Not only does coal currently provide employment for almost 100 000 South Africans, but geologically South Africa is an immensely coal-rich country, and the reality is that it is still the cheapest and most abundant form of energy to leverage for economic development. It must therefore be fully exploited to ensure a stable supply of energy overall.

The precarious balancing act that policymakers must now navigate should therefore not threaten the economically crucial coal sector with competition from gas and renewables, but rather see it as a critical tool in the energy mix as we shift towards a more sustainable economy. The shift towards cleaner coal, however, will take centre stage. Compliance to more stringent international standards and protocols means that it’s much more difficult to get approval for new coal mining operations than in the past. As such, many existing operations are being retrofitted for decarbonisation, to reduce their scope-1 emissions.

From an ownership point of view, as the demand for coal reduces, the integrated diversified mining houses will shift away from coal and give way to localised, smaller, more focused players in the market.

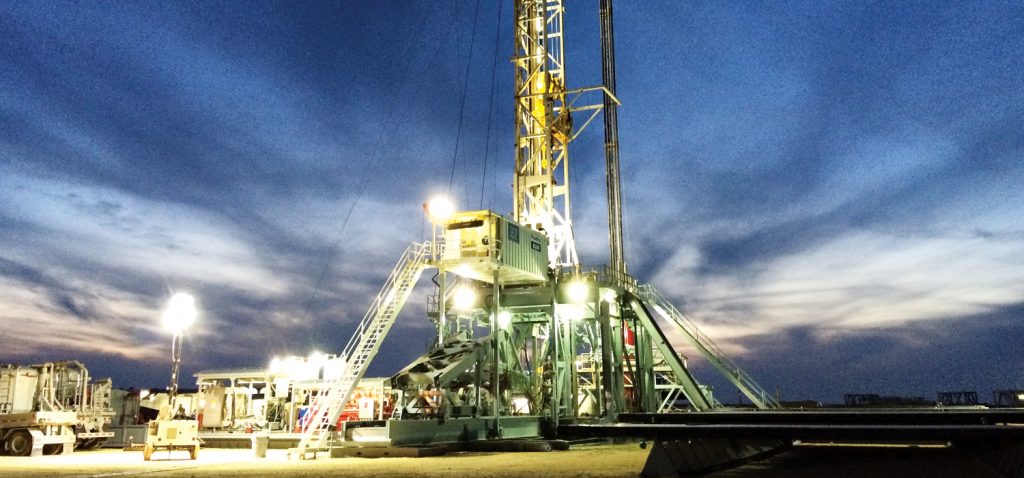

Natural gas

Another important emerging trend to look out for in 2021 is the proliferation of liquefied natural gas (LNG). The current abundant supply of this resource globally could contribute to a significant injection of vitality into this industry in SA this year.

Natural gas is cleaner and less environmentally hazardous than coal, and cheaper at this point than renewables. It exists abundantly in various forms, as yet untapped, beneath the various geological formations of Southern Africa, which is thought to have some of the largest natural reserves of shale gas in the world. However the exploitation of this gas is a lengthy and expensive process.

Natural gas makes up a significant portion of the energy mix in Africa overall, and it currently accounts for about 7% of SA’s energy supply. Furthermore new discoveries of onshore (and offshore) gas deposits have been more frequent over the past 10 years. An example of the rapid development of infrastructure to facilitate the trade in LNG is the Mozambique-to-SA pipeline. Mozambique is home to some of the biggest reserves yet discovered and significant investments have been made in order to unlock and harness this resource.

The efficiency of gas to power is very good, and just as in other nations, we believe that LNG and potential pipeline developments will play a comparatively larger role in domestic and industrial power generation in SA going forward. Heating in particular can be achieved more cost-effectively with gas than via electricity. The reliability of LNG supply locally means it is a vital ingredient to stabilising the energy sector, which will have far-reaching knock-on benefits.

Renewables

Renewables are the third major player in this “holy trinity” of SA’s energy mix. Set to account for around a quarter of SA’s overall energy supply in the next 20 years, renewable energy sources are backed by widespread public approval and are capturing a deep share of the investment wallet. Solar in particular is especially attractive as production costs are now lower than ever before.

The biggest obstacles to widespread uptake of renewables currently are the challenges around power storage and transference to the national grid. Investments into novel battery technologies could potentially facilitate a solution to the storage conundrum that could radically alter this landscape.

SA is currently in the fifth round of bidding and research in which independent renewable energy producers vie to provide profitable power for the state’s energy matrix.

In the mining sphere we’re seeing more players – including coal mines – opting for renewables to power their own operations in-house, which also guards against the loss of productivity incurred during load shedding which has hitherto threatened the sustainability of many an operation.

Transport

The global demand for cleaner energy will continue to drive research and development into gas- and electric-powered vehicles, including long-haul trucks. However this technology has not matured sufficiently to allow for non-traditional fuels for the airline industry.

South Africa’s primary car export market being Europe, it is imperative that these manufacturers move away from the traditional internal combustion engines to ensure sustainability of the industry.

Globally there is a strong move towards electric vehicles and their capacity to provide public transport solutions and movement of goods, but in SA for the short term the penetration of such technologies will be minimal, as widespread uptake would need to be enabled by an all-new infrastructure which would have to include charging stations and the like.

The economic recession has led to more money being diverted to infrastructure development, which will in turn catalyse rejuvenation and a reimagining of the energy space. SA should seek self-reliance within all aspects of the energy supply chain and aim to be an exporter of technologies like storage capacity and power-engineering solutions.

But for the next year, as an emerging market our focus must be on holistically managing the energy transition goals with the economic and social obligations to the people of SA who are still heavily reliant on traditional coal-based energy. Our investments into gas and renewables must be a synchronised collaboration with the coal sector, and not pit one against the other.

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.