SA Mining PR

Project And Corporate Update

Highlights

- Minergy will become a producer following first commercial sales

- 340,000 tons in-pit coal exposed

- 5m cubic metres of overburden removed

- First long-term contract signed for 120,000 tons per annum

- Technical work ongoing to declare first Opencastable Reserve at Masama

- Internal estimates of 55-65 Mt

- Internal estimates of Saleable Coal: 30-40 Mt

- Internal analysis indicates project NPV of US$100-130m

- IRR over 100%

- >22-year mine life

Project Update

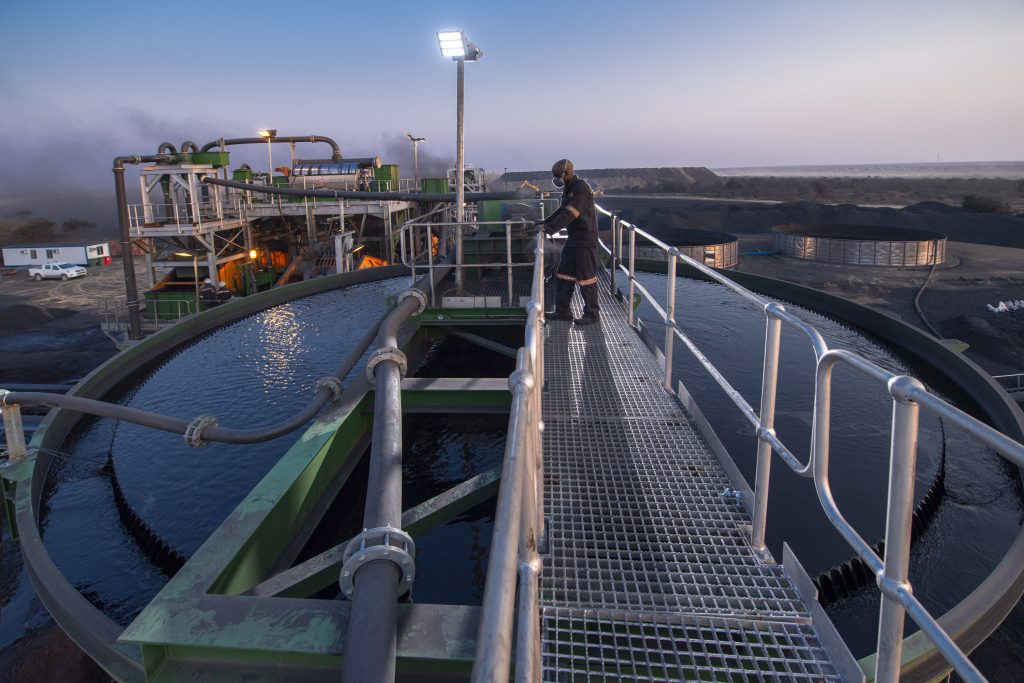

Following successful start-up of mining operations, the Company has exposed the first 340,000 tons of coal, which represents approximately 3 months’ nameplate production. In doing so, the Company has removed over 2.5m cubic metres of overburden. The Company is extremely pleased with both the timing and the progress made at the Masama Coal Project, which is will be transitioning from mine development into a mining operation at full production.

The Company is pleased to announce that during September 2019 it will record its first commercial sales, and the ramp-up of its operations is on-track. At present, the Company is mining 110,000 tons per month, resulting in 70,000 – 80,000 tons of saleable coal. The saleable coal target is expected to increase to 100,000 tons per month in early 2020. Several opportunities to significantly increase production will be assessed going forward.

The Company is completing the process to sign its first long-term contract, to deliver 120,000 tons of coal per annum to one regional industrial customer, which represents approximately 10% of estimated annual saleable coal. Discussions are underway with a number of other interested regional industrial customers, many of whom have already tested samples of the Company’s coal over the past few months and the Company is confident of signing additional customer contracts in the coming weeks.

Indicative financial metrics for the project:

The Company has engaged a firm of experts to undertake significant technical work to finalise the mine plan to be conducted at Masama. The Company is pleased to announce that based on work completed to date, extremely encouraging results are expected.

Since the technical review is still a work-in-progress, the information contained in this announcement is not based on the final SAMREC (The South African Code for the Reporting of Exploration Results, Mineral Resources, and Mineral Reserves) or SAMVAL (The South African Code for the Reporting of Mineral Asset Valuation) reports which are currently being prepared, however, provides an indication of the results expected by the Company based on work completed so far. To further take this into account, the information below is also presented in range bands which will be clarified with more accuracy after the conclusion of the technical review.

- NPV10 (Net Present Value) range of US$100 – US$130 million (P1,100 – 1,430 million)

- Targeted IRR (Internal Rate of Return) greater than 100%

- Payback period < 2 years

Key assumptions include a blended average selling price of US$50-55 per ton (P550-605 per ton) (this is, however, dependant on product type as well as quality) and cash operating costs of US$40-45 per ton (P440- 495 per ton). The Company is subject to a 3% revenue royalty and 22% income tax rate. Closure costs for the opencast phase have been accounted for.

Coal Resources and Coal Reserves:

A Coal Resource of 386 Mt has been defined in terms of the preliminary workings for the project and comprises Opencastable and Underground Mineable Resources in the Measured, Indicated and Inferred Resource categories as presented in the table below, which is based on an extract from the work in progress.

Opencastable Coal Reserves are currently in the process of being calculated and ROM Coal Reserves are likely to range between 55 and 65 Mt, with resultant Saleable Coal Reserves likely in the range of 30 to 40 Mt.

Potential production growth:

The Masama project has a 386Mt Coal Resource. Of this, approximately 82 Mt is considered opencastable, giving a life of mine (“LOM”) of 22 years. The remaining approximately 304 Mt is considered mineable by underground mining methods and could significantly extend the LOM. Prior to the opencastable Resource being exhausted, a detailed assessment of underground mining will take place. In addition, there are also plans to conduct further exploration on the remainder of the prospecting licence, which is substantial and currently totals at 352 km2.

Depending on the economics at the time, opportunities to significantly increase production include increased supply to industrial customers, export opportunities, or power generation. Increased production would require additional capex primarily to increase the capacity of washing plant and plant infrastructure, and completion of an additional box cut.

Corporate Update

Minergy is progressing towards its previously stated objective of listing on the Alternative Investment Market (“AIM”) of the London Stock Exchange (“LSE”) and looks forward to providing further updates in due course.

Minergy CEO, Morné du Plessis, commented:

“The team is extremely proud of what has been achieved in a relatively short period of time, not only for Minergy but for the development of the coal sector in Botswana. Minergy has pioneered a process that will support the regional industrial demand for coal and in so doing, benefit the people of Botswana through job opportunities and vital coal skills development.”

The information contained above is in the process of being verified through the commissioning of an independent review of these numbers and confirmation of such will be supplied to shareholders when available.

Shareholders are reminded that the company is currently in a closed period and accordingly, shareholders are advised to exercise caution when dealing in the Company’s securities until the release of the final results for the year ended 30 June 2019 which are expected to be released during the last week in September 2019. Shareholders are further cautioned that the information in this announcement is not currently compliant with the SAMREC or SAMVAL codes and rather represent the Company’s expectations based on work completed to date from the technical review.

Morné du Plessis

Chief Executive Officer

Minergy Limited | Unit B3 and Unit B4 | 1st Floor | Plot 43175 | Phakalane PO Box AD 10 ABC | Phakalane |Gaborone Tel: +267 397 2891 | Fax: +267 397 2893

Sponsoring Broker: Imara Capital Securities (Pty) Ltd

Transfer Secretaries: Corpserve Botswana Unit 206, 2nd Floor, Plot 64516 Fairgrounds, Gaborone, Botswana Tel: +267 393 2244 Email: contactus@corpservebotswana.com

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.