Sunday Times Consulting

BASEL IV – Potential Into Practice

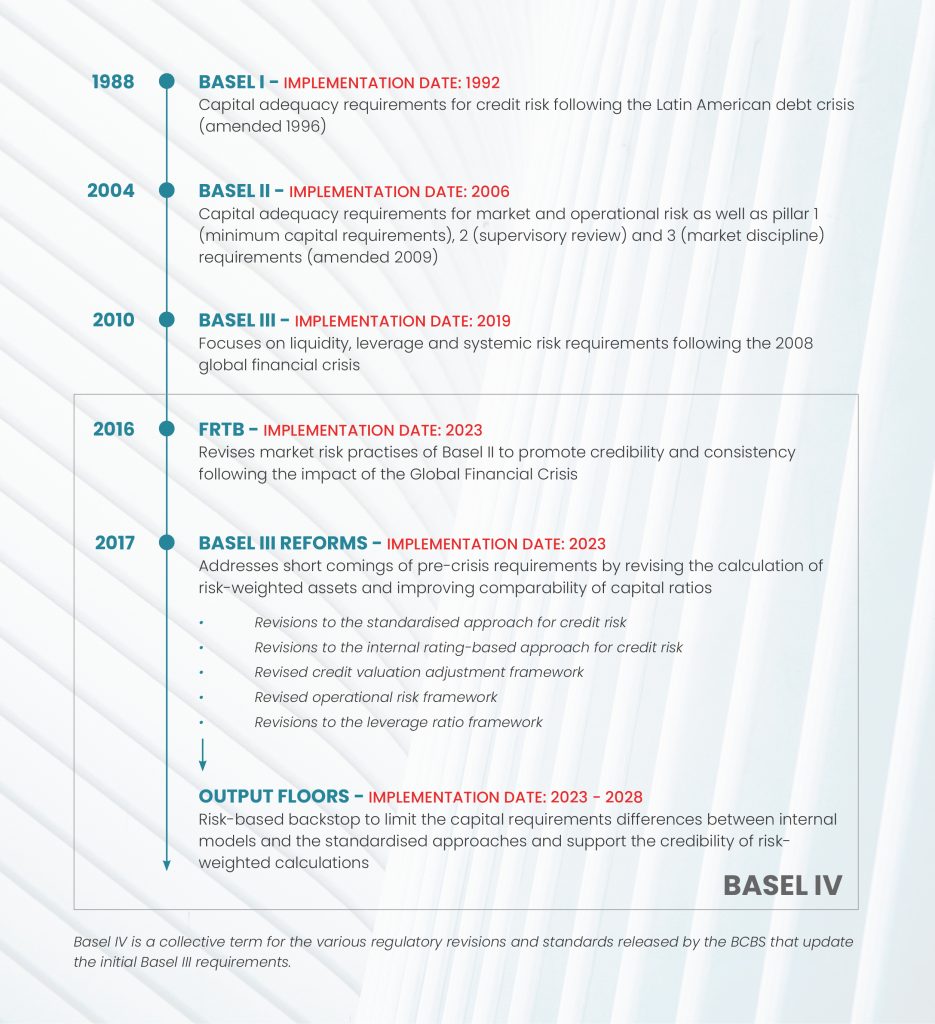

In December 2020, the European Banking Authority (EBA) reported that EU banks are facing a €52 billion capital shortfall in terms of complying with the finalised Basel III reforms (colloquially known as Basel IV). The reforms specifically aim to restore credibility to the calculation of risk weighted assets (RWA) and ensure greater comparability of banks’ capital ratios, but many banks tend to focus their attention on the financial impact of these reforms, citing increased capital requirements, diminished return on equity and possible adjustments to business models.

Despite these objections, the execution of these reforms cannot be neglected. Simply put, the effective operationalisation of the Basel III reforms through future-proof capabilities and infrastructure changes cannot be overlooked in order to prevent implementation and maintenance costs from eroding business and portfolio optimisations.

Many regulatory capital management and reporting solutions would have been designed and built to accommodate the simpler credit, operational and market risk requirements of Basel II in 2004. While banks will no doubt have iteratively improved and optimised their various data and modelling processes these solutions will most likely be inflexible and ill-suited for the more dynamic and granular Basel IV requirements.

As banks continue to implement regulatory capital changes, a tunnel vision approach of building a rigid Basel IV solution that ticks the box of compliance must be avoided. Such an approach often leads to the accumulation of technical debt as iterative updates must be constructed on top of the solution to meet the inevitable developments in the ever-changing Basel framework.

Principally, a regulatory capital solution must prioritise flexibility and scalability that enables a modular design supported by automation and standardisation to efficiently implement continual regulatory revisions. Such a solution becomes a strategic decision-making tool, where ad hoc stress testing and Quantitative Impact Study (QIS) exercises can be performed without the obstacle of excessive time and effort commitments. Banks now have the opportunity to use their allocated reform budgets to overhaul weak capabilities in their end-to-end regulatory capital function.

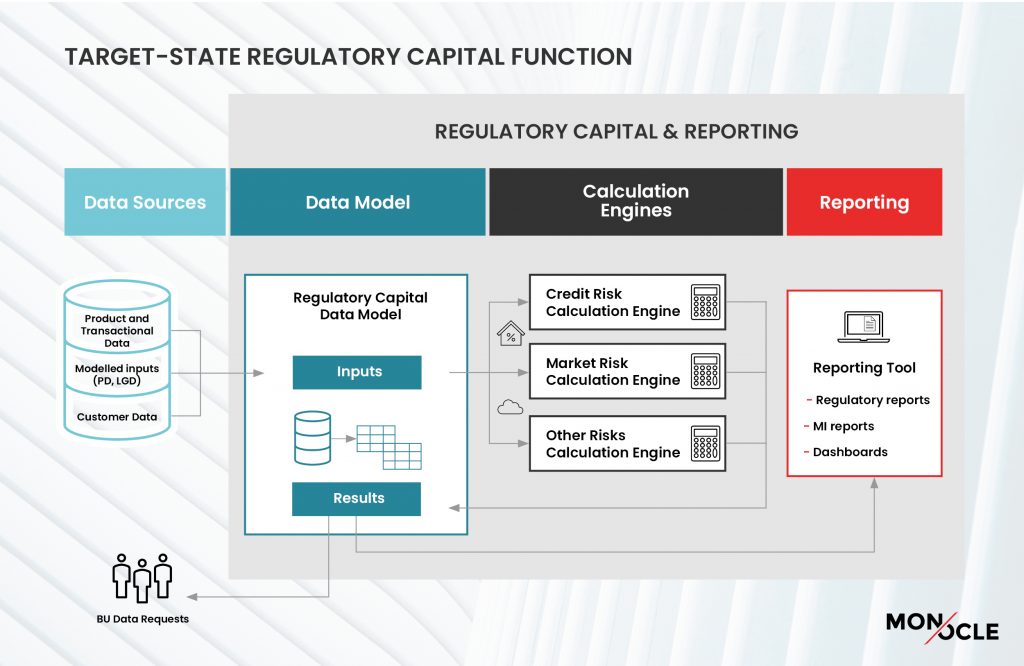

Data Modelling

At the heart of a successful Basel IV implementation is meeting the requirement for a robust regulatory capital data model. It is important that the data model correctly captures and standardises the data elements needed for calculation and reporting input, as well as the attributes needed to perform various Basel classifications. It is not uncommon for banks to extract and load their data directly into their calculation engines, however, various sources with fragmented data conventions will lead to increased data preparation efforts and manual interventions to meet engine data needs. The lack of data ownership by the regulatory capital function causes an over reliance on IT for extract-transform-load development.

Banks that continue to ignore best practice of relational database modelling will find the increased number of data points and granularity difficult to incorporate and maintain. It is therefore important as banks update their data models to have a strong balance of knowledge and expertise regarding:

- Basel Reforms Regulation: Comprehensive and detailed understanding of the regulations, including changes in risk-weights and buckets, updates to model approaches and parameters, classification, and segmentation updates.

- Bank Product Idiosyncrasies: A comprehensive internal view of the bank’s products, risk metrics and business models, including their products’ intrinsic characteristics such as signage conventions, exposure breakdowns and other data elements and conventions that exist on each source system. Without this, banks will struggle to translate and match the general regulatory terms and requirements with their own data elements.

- Data Principles: Database and data modelling expertise that prioritise reduced data redundancies, controls for data quality and integrity, and enable scalability for future updates. A standardised data model for regulatory capital should be utilised and enforced, in order to avoid a data model that specifically accommodates a singular downstream process to the detriment of other calculation and reporting processes. The concept of a system and process “agnostic” data model provides a simplified and consistent translation layer between up- and downstream systems without being beholden to any one source, calculation engine, or reporting process’s data needs, resulting in more flexible integration capability.

Banks will often have limited expertise on one of these three capabilities, which can result in challenges in complying fully with the Basel reforms, matching the bank’s activities to the required changes, or effectively implementing a data model to capture the reforms. These inefficiencies not only result in chronic process disruptions but can compromise the reliability and validity of capital calculations.

Calculation Engines

The multitude of standards and revisions associated with Basel IV illustrates the point that regulatory requirements are in a constant state of flux. Banks with an agile computational capability that can match the rate of change efficiently will reap the benefit of reduced RWAs and improved economic profit. Additionally, banks can better fulfil their Quantitative Impact Study obligations and perform ad hoc stress testing exercises, which became especially important during 2020, when banks were placed under significant pressure to quantify their resilience and risk impacts with the onset of the Covid-19 pandemic.

Previously, banks have sought to build regulatory capital calculation engines in-house for simpler calculations, but the scale of Basel IV regulatory requirements has made the option of purchasing a pre-built, off-the-shelf calculation engine from a vendor a more appealing option. The business case for a vendor offering is typically economy of scale benefits, access to technical IT and regulatory experts and the relief of the burden of model and system maintenance through product support. Today, there are many software vendors providing various levels of calculation and reporting capabilities. Banks need to perform thorough due diligence to make sure that they choose the right solutions for their unique requirements and required functionality, as well as to avoid overspending. Consulting implementation experts are well equipped to assist with these challenges.

The success of vendor calculation engines is, however, often dependent on the realisation of a well-executed installation. Consideration must be given to, for example, the implementation of a standardised, agnostic data model, which is required to effectively integrate with the bank’s data source(s). Banks should therefore be prepared to actively configure, review and implement these products alongside their vendor to ensure they meet the desired objectives. Similarly, each calculator should produce output results as per the standardised data model to ensure consistency and ease of use across downstream reporting and review processes. Banks may find themselves with a mix of in-house and outsourced calculation engines, both requiring effective management and oversight through a comprehensive operating model

Regulatory Reporting

Banks have onerous reporting requirements relating to their relevant regulators but also need to produce extensive internal reporting for analysis and insights, as well as provide specific result datasets to various teams within the bank. These teams include internal modelling teams for model calibration purposes, finance for annual financial reporting, and various business units for capital allocation analytics.

Once again, a standardised data model in which results across the various calculation engines can be fed back is critical to ensure consistency and flexibility throughout the various reporting activities. This will also better enable data lineage mapping and improve the transparency of the process, resulting in better auditability, with reporting usually being the starting point and focus for external auditors.

Additionally, automation of these reporting processes – usually offered in dedicated reporting tools – can reduce manual, repetitive reporting processing, such as data quality checks, aggregation and classification, which are often completed and reconciled on Excel. Automated validations and reconciliations between finance and risk data are of paramount importance and banks will be hindered by the data model if it fails to successfully aggregate and consolidate results correctly, reconcile to financial statements and control for data quality. Any improvement in the transparency of the process results in better auditability with reporting usually the starting point and focus for external auditors.

Worldwide, banks have increasingly required consulting and advisory services to achieve compliance with the Basel regulatory framework as it grows in complexity and scale. Through our comprehensive understanding of the regulations, as well as data and system management, we assist our clients in operationalising and implementing the required changes at a data and process level.

- We design fit-for-purpose, regulatory data models that adhere to best practice data principles, as well as assisting with implementation and integration of vendor provided solutions, such as regulatory calculation engines.

- We conduct process auditing to vet and confirm data quality, as well as process and code efficiency, to ensure the validity and reliability of regulatory capital results.

- We design and build reporting solutions and the reporting tasks required. This includes external regulatory reporting, business intelligence visualisations and management information system dashboards, in order for banks to better visualise and analyse their results.

Taking into account our client’s specific product offerings, balance sheet composition, regulatory approaches and requirements, we provide regulatory advisory services to simplify and solve for regulatory compliance, allowing our clients to focus on optimising their capital allocations and executing insight driven strategic business decision making.

To find out more about Monocle and how we assist industry-leading banks and insurance companies around the world visit www.monocle.co.za.

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.