Business Day Payments Business Day Payments PR

Stitch Partners With Standard Bank Shyft To Enable Instant Wallet Top-Ups

Payments infrastructure company Stitch has partnered with Standard Bank’s Shyft, the global money app, to enable instant top-ups on the Shyft wallet for customers from any bank in South Africa. The solution is a response to growing demand from Shyft customers for more immediate access to their funds.

For the global citizens that rely on the Shyft wallet to more easily travel, shop, pay, and invest, speed and convenience are paramount. After noticing a considerable upward swing in global transactions – and increased demand from customers for faster access to their funds – the Shyft team needed a payments partner that could help them modernise their payments stack and bring instant payments to the Shyft wallet.

“The choice of strategic partner depended on a reliable payments platform that could deliver speed, convenience, security and control for our customers,” said Dani Morley, Executive Head of Growth at Shyft. “Partnering with Stitch has enabled us to fulfill our clients’ expectations with unprecedented speed. Since customers from any bank can already onboard successfully onto Shyft, this collaboration allows us to continue providing exceptional service, and pricing, to clients from any banking institution by facilitating the funding of Shyft wallets from any bank card.”

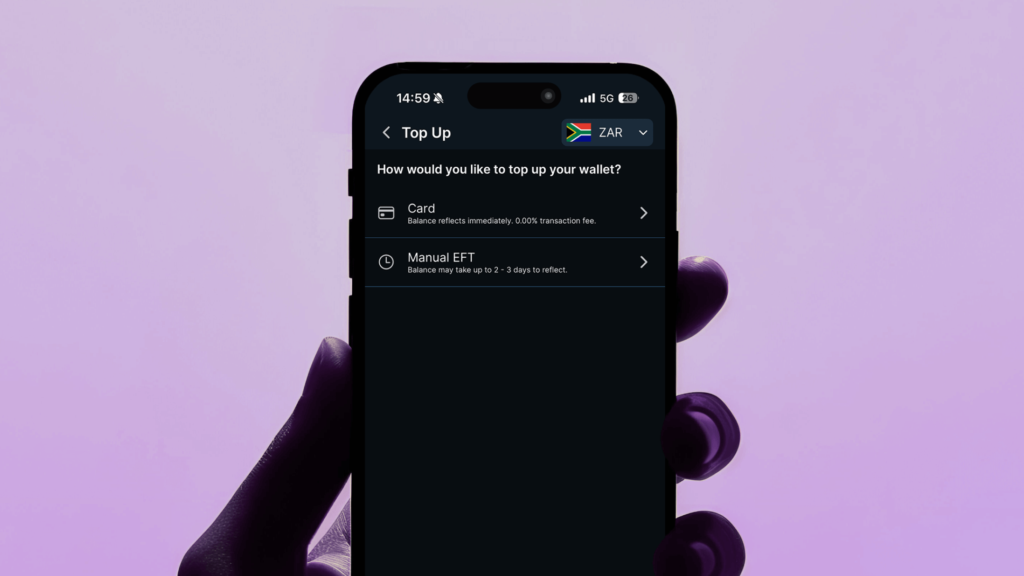

The Shyft team trusted Stitch to manage their payments, leveraging their highly reliable card payments platform for instant top-ups on Shyft. Previously, customers needed to wait 2-3 days for funds to appear in their wallet via manual transfer. Now they can start moving money instantly, and don’t need to worry about liquidity.

Lusanda Dlamini, Head of Card and Payments at Shyft, echoes the unparalleled efficiency of the Stitch team. “Our commitment to delivering seamless customer journeys is ingrained in everything we do, and Stitch has consistently matched our energy. There are many ways to access the global financial economy, but it starts with apps like Shyft, and partnerships like the one with Stitch to deliver payment services the way our customers want it.”

As well, Shyft is waiving transaction fees on all ZAR wallet top-ups from now until 14th March.

“We’re excited to work with Standard Bank to bring this innovation to market and introduce an even better customer experience on the Shyft app,” said Kiaan Pillay, CEO and Co-founder at Stitch. “Shyft customers rely on them for money movement that often requires just-in-time access. They needed a payments partner that can deliver on the speed and reliability their customers expect. With instant top-ups via bank card through Stitch, now Shyft customers from any bank can invest, exchange funds, send money to friends and family and much more – in real time.”

Shyft customers can make instant top-ups now on the Shyft app. Anyone interested can download the app by visiting shyft.co.za or by scanning this QR code:

Businesses interested in offering instant wallet top-ups with Stitch can get in touch at sales@stitch.money.

Stitch emerged from stealth in February 2021 and has raised $52 million in total funding to date. Today, Stitch infrastructure powers leading global and African businesses across sectors, including MTN, Luno, The Foschini Group (TFG)/Bash, Vodacom, Cell C, The Courier Guy and more.

For further inquiries, contact thea@stitch.money.

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.