Business Day Payments PR

The Enterprise SoftPOS Evolution

Author: Melissa Kramer

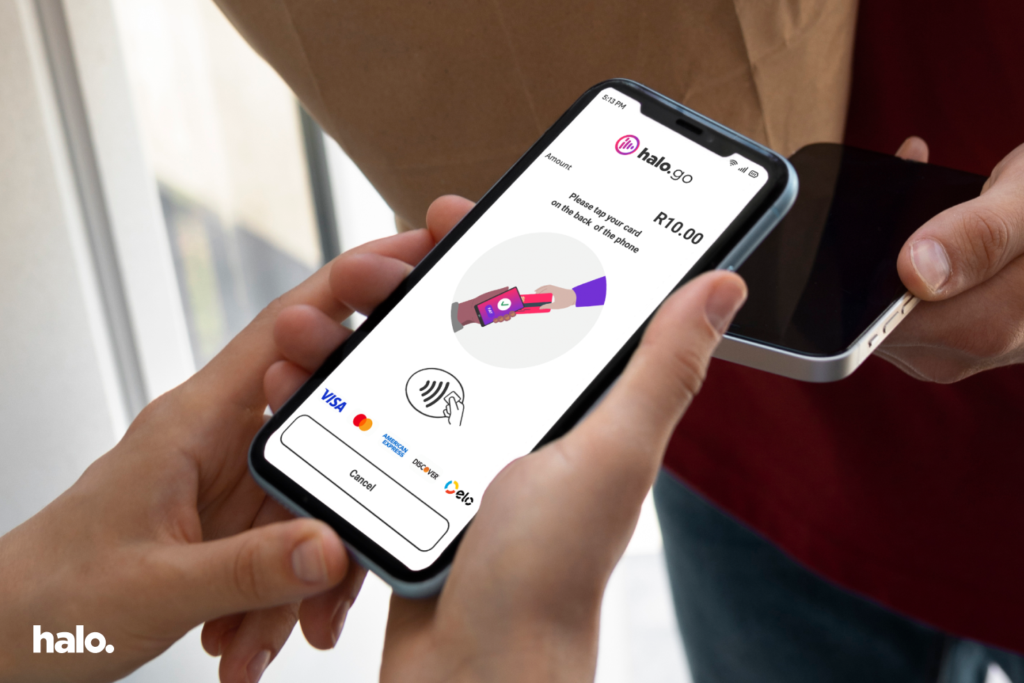

Halo Dot, a South African-born fintech company part of JSE-listed Capital Appreciation’s payments division, has been at the forefront of this transformation since creating Africa’s first SoftPOS solution in 2021.

The Growing Opportunity

The numbers tell a compelling story. Contactless payment transaction values are projected to reach $15.7 trillion by 2027, according to Juniper Research. This growth is being accelerated by major tech companies like Apple, whose Tap to Pay on iPhone feature is now available across more than 30 regions globally, potentially adding over 1.2 billion iOS users to the SoftPOS market.

For enterprise leaders, the shift represents an expansion of operational capabilities rather than a replacement of existing systems. SoftPOS technology complements traditional POS infrastructure by expanding the payment acceptance fleet within existing environments. By leveraging mobile devices to process contactless payments, SoftPOS solutions work alongside fixed terminals to extend payment capabilities throughout the storefront or service area.

Today’s SoftPOS platforms maintain the same security standards as traditional terminals, with PCI MPoC and PCI DSS compliance, encrypted transactions, and full scheme certifications across major card networks. This evolution has opened new possibilities for businesses across retail, hospitality, logistics, telecommunications, and financial services sectors, to name a few.

Halo Dot’s Unique Approach

What’s emerging as a critical consideration for enterprises is deployment flexibility. While most SoftPOS solutions follow a one-size-fits-all approach, Halo Dot recognised early on that different organisational requirements demand different hosting methodologies. The company pioneered a unique differentiator: offering both managed and self-hosted deployment optionality.

Managed hosting provides turnkey deployment with cloud-based infrastructure and comprehensive support, suiting organisations prioritising rapid implementation. Self-hosted deployments offer complete control over payment infrastructure, allowing integration with existing backend systems and enhanced visibility into transaction

Beyond Basic Payments

Advanced SoftPOS implementations extend beyond simple payment acceptance. Emerging “Tap on Own Device” capabilities could potentially allow consumers to use personal devices to complete online payments, with the potential to enhance both security and user experience.

These capabilities could drive adoption across various sectors. Transit systems might explore SoftPOS for mobile ticketing, whilst financial institutions may consider it for secure customer authentication.

The Strategic Advantage

For executives evaluating SoftPOS adoption, the technology represents an opportunity to enhance payment acceptance capabilities whilst maintaining existing physical infrastructure investments. SoftPOS works alongside traditional terminals, extending payment acceptance into new environments rather than replacing established systems.

As the payments industry continues its digital transformation, SoftPOS technology is establishing itself as a valuable addition to existing payment infrastructure, creating opportunities for businesses to serve customers elsewhere.

Organisations interested in exploring SoftPOS implementation can learn more about deployment options at www.halodot.io.

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.