Business Day Payments PR

Stitch Acquires Efficacy Payments, Secures DCSP Designation To Offer Card Acquiring Services

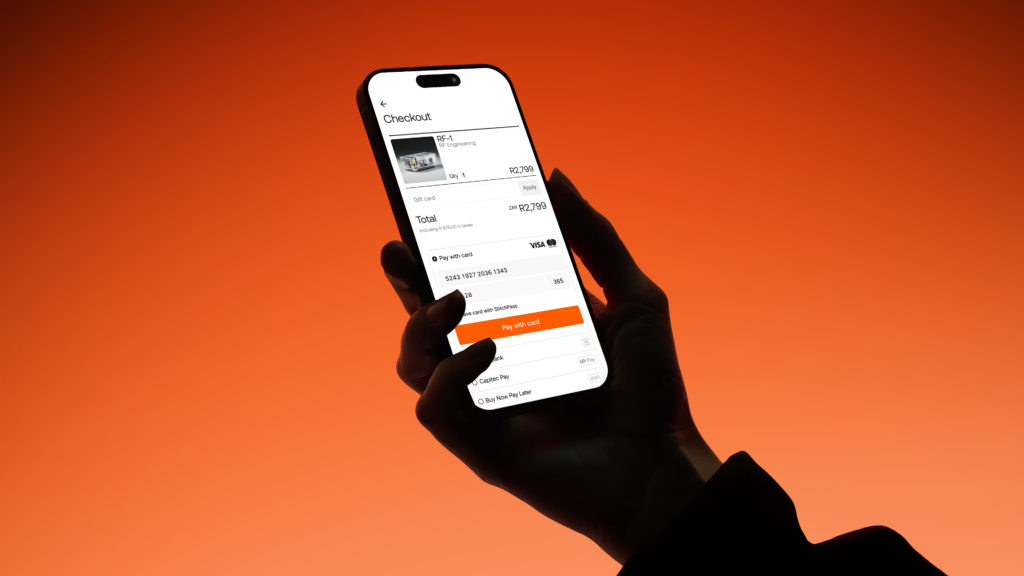

South Africa-based payments infrastructure company Stitch has announced acquisition of Efficacy Payments, its second major strategic acquisition, enabling the firm to offer card acquiring services directly to merchants as a Designated Clearing System Participant (DCSP), and provide more seamless and cost-effective transactions.

By bringing Efficacy within the Stitch group, Stitch has become one of the first fintechs in South Africa to offer direct card clearing both online and in-person, underscoring its commitment to serving clients across more of their payments needs.

As a designated clearing system participant, Stitch can offer a comprehensive, end-to-end card product with full control over the whole product lifecycle.

- Stitch is the gateway, switch and the acquirer: Merchants can work with one provider that can perform the end to end acquiring service across technical, compliance, financial and operational requirements

- Stitch Group is directly connected to Visa and Mastercard: There is no dependency on an intermediary acquiring bank or switch, removing potential failure points from the transactions

For enterprise merchants, this results in:

- Better conversion: due to optimisations in the way messages are passed through card networks

- Faster access to new products and features: due to a reduction in bank and third party dependencies and delays, Stitch has greater autonomy to provide the latest products and features to its clients

- Real time reporting and reconciliation: merchants monitor the state of their payments and associated fees through a real-time view of transactions, as well as set up custom reporting at various frequencies, with fewer settlement and reconciliation issues

- Cost savings: from lower fees by working with one provider, thanks to optimisations in the way messages are sent, and a reduction in the need for internal resources to manage reconciliation across multiple interfaces and multiple parties

“We’re excited to welcome the Efficacy team into the Stitch Group and offer this critical solution to the merchants we work with. Card processing is an essential requirement for businesses in South Africa, and we’ve seen a lot of room for improvement when it comes to conversion, recon capabilities and access to the latest technology. We’re excited to see the impact this will have on the way our merchants collect card payments from their customers,” said Junaid Dadan, President and Co-founder at Stitch.

2016, and it was designated as a clearing system participant in 2021, as the second fintech in South Africa to achieve this.

This is the second major acquisition for Stitch, following its acquisition of ExiPay in January 2025, which allowed the firm to expand from online payments into the in-person payments space. Today Stitch offers a true omnichannel payment platform, allowing multi-lane retailers, telcos and other omni-channel businesses to modernize their in-store and online payment experiences.

Stitch emerged from stealth in February 2021 and has raised $107 million in total funding to date, including its recent Series B round of $55 million announced in April 2025.

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.