Payments Payments PR

Bridging The Payment Gap – How PayCentral Is Enabling Financial Inclusion And Business Growth

PayCentral, a proudly bootstrapped fintech company, is leading the way in alternative payment solutions, providing South African businesses with seamless, secure, and scalable ways to pay salaries, manage expenses, and reward employees.

Built from the Ground Up – A Homegrown Success Story

Unlike many fintech companies backed by large investors, PayCentral has grown organically, building its reputation on trust, agility, and technology-driven solutions that meet the real needs of businesses. Over the past nine years, the company has transformed from a small startup into a thriving business that serves over 1,000 companies across 50 industries.

“Our journey has always been about solving real-world business challenges with technology. We’ve had to be agile, innovative, and deeply connected to our clients’ needs to build something that truly adds value,” says Preniel Pentia, Director of PayCentral.

The Power of Seamless Alternative Payments

Businesses operating in industries with high employee turnover, casual labour, and large-scale field operations – such as call centres, marketing agencies, agriculture, and manufacturing – often struggle with payroll inefficiencies, expense tracking, and rewards distribution.

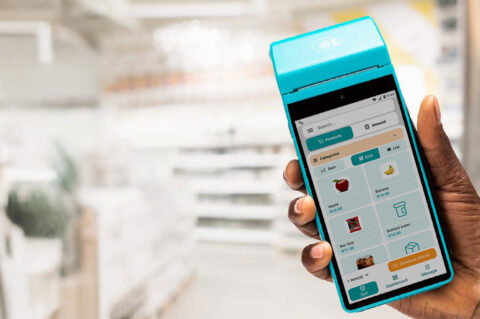

PayCentral’s CashCentral and CashCentral+ card products provide a secure and efficient alternative to traditional banking, particularly for companies that employ unbanked or underbanked workers. These prepaid and reloadable cards allow businesses to:

- Pay salaries and wages instantly, eliminating cash-handling risks.

- Manage employee incentives and expense budgets seamlessly.

- Reduce administrative burdens through an easy-to-use, fully integrated digital platform.

For decision-makers looking to drive business growth while ensuring employee satisfaction, alternative payments offer a streamlined solution that improves financial transparency and operational efficiency.

A Technology-Driven Approach to Business Payments

At the core of PayCentral’s offering is a custom-built card management platform that integrates seamlessly with businesses’ existing operations. Through real-time transaction tracking, automated reconciliation and downloadable reports companies gain greater financial control and actionable insights to optimise workforce management.

“What sets us apart is the technology that powers our products. We are constantly evolving our proprietary fintech platform to help businesses make better, faster financial decisions,” adds Veenash Parbhoo, PayCentral Founder and Director.

A Future of Growth and Inclusion

With over R4.8 billion in total card spend and 10.5 million transactions processed, PayCentral continues to expand its reach beyond borders, helping businesses bridge the financial gap for thousands of employees.

As South Africa’s payment landscape evolves, PayCentral is proving that innovation, financial inclusion, and business agility are key drivers for success. With a relentless focus on client-centric solutions and cutting-edge technology, this bootstrapped fintech is setting new standards in the alternative payments space.

For more information on PayCentral’s alternative payment solutions, visit www.paycentral.co.za.