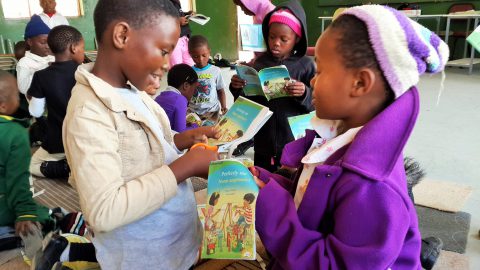

The South African Schools Collection

Curro’s Strong Financial Performance Leads to Long-Term Rating Upgrade by GCR

Eyal Shevel, Sector Head of Corporate ratings at GCR, says the upgrade of Curro’s long term rating from BBB-(ZA) follows the Positive outlook monitored during the previous ratings period. He says Curro demonstrated a sustained strong performance in 2015 with projections for the next 24 months indicating robust operating results and cash flows.

“The ratings factor in the growth of Curro’s portfolio, with their market strength continuing to gain momentum, having grown into the largest listed private school operator in South Africa over a relatively short period. Curro’s low and scalable cost structure has allowed it to respond to market demand and generate strengthening cash flows over the review period. Demand for independent schools as an alternative to the public education system is expected to remain strong. This particularly holds true for the low-and mid-fee schools in view of the tough economic environment. Accordingly, maintaining affordable tuition fees may be a challenge in the face of rising competition and external cost pressures,” says Shevel.

Curro continues to register strong student enrolment year on year, thus boosting school capacity utilisation at both new-builds and mature schools, and in turn revenue and earnings growth. Accordingly, revenue rose by 38% to R1.4 billion in 2015, whilst the higher 34 campuses reported increasing capacity utilisation levels above the breakeven inflection point. This saw the Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA) margin strengthen to 21% in 2015.

However, Shevel cautioned that debt has increased from R135 million at Financial Year End (FYE) 2011 to R1.6 billion at FYE 2015 and is likely to be even higher at FYE16. “Nevertheless, having peaked at 66% at FYE 2014, net gearing has since moderated to 49% at FYE 2015, whilst net debt to EBITDA also improved to a review period low of 465% at FYE 2015. Similarly, despite the higher debt, gearing metrics are projected to be within GCR’s comfort level at FYE16.”

Further comfort is gained from the strong support of shareholders, with Curro having raised R3.8 billion in fresh equity since listing.

Shevel notes that as the current ratings upgrade has taken into account the strong projected earnings for 2016 and 2017, a further upgrade would only likely be achievable if Curro was to exceed targets over the medium term. A rating upgrade could also materialise if Curro’s growth were to slow, such that cash generation could be available to redeem a meaningful portion of existing debt.

Shevel concludes, “Negative rating action could be considered if business fundamentals deteriorate abruptly, leading to a weaker operating performance and cash flows, or if the company were to pursue significant additional borrowings beyond its current plan. An adverse change in level of support to Curro from PSG would also negatively impact the group’s credit risk profile.”

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.