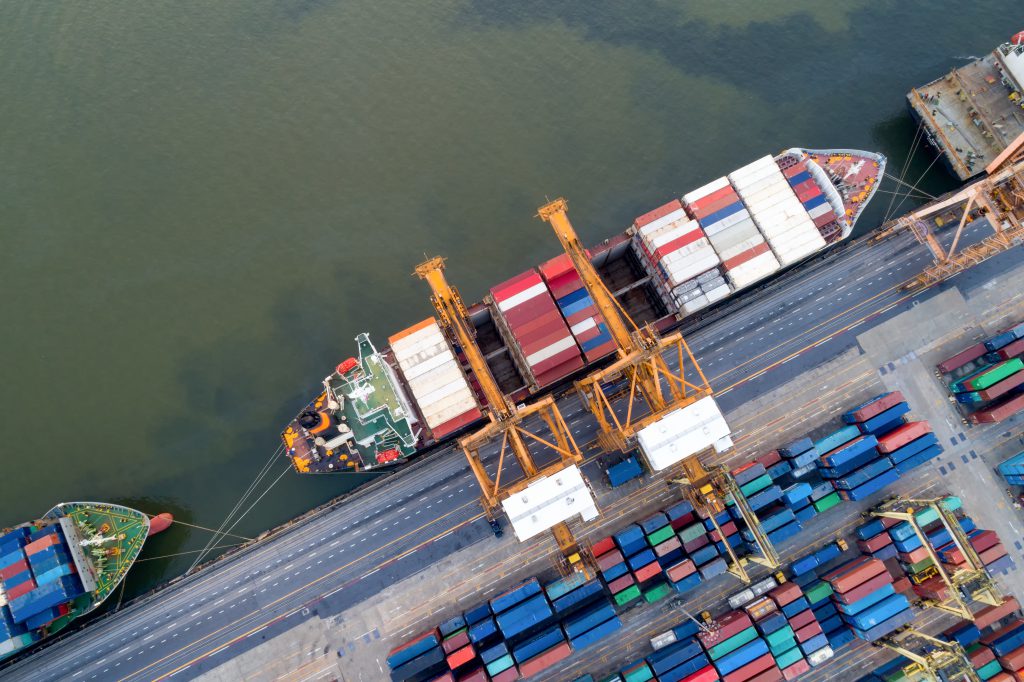

Freight, Logistics and Warehousing

Vigilance & Wisdom

Analyses of statistics in the logistics and freight industry reveal that businesses face great risks in an environment characterised by significant and rapid economic, social and environmental change. In such a multi-faceted industry, inefficiencies in one part of the supply chain can negatively affect the performance of the supply chain as a whole.

“Companies operating in this industry are compelled to reduce costs, improve the quality of our services, identify new growth opportunities and increase productivity if we are to continue to be competitive and successful,” says Kate Stubbs, executive: business development and marketing at Barloworld Logistics. “This continuous and increasing focus on cost containment places pressure on margins and as such, commercial models need to become increasingly creative and flexible in order to adapt to market demands to continually unlock value for customers.”

In 2015, Professor Johanna Badenhorst-Weiss and Dr Beverly Waugh, both from UNISA, published the results of a study in an article called, “A logistics sector’s perspective of factors and risks within the business environment that influence supply chains’ effectiveness:

An explorative mixed method study” in the Journal of Transport and Supply Chain Management.

The study found that increasing transportation costs, operational management of infrastructure and human resources-related problems pose the biggest challenges in the logistics industry. Respondents to the study ranked infrastructure quality in South Africa as the most important problem facing the industry, followed by operational inefficiencies, increasing transportation costs, labour relations in the industry and shortage of skilled and experienced supply-chain staff.

Transport and infrastructure

Transport infrastructure, the biggest and arguably the most important component of logistics infrastructure, is a critical ingredient for economic growth, development and wealth creation in any country. Poor quality infrastructure makes it very difficult for logistics companies to serve their customers. In this respect, role-players in the logistics and freight industries are largely dependent on the state and parastatals to maintain and upgrade the transport network, making this a very difficult risk to manage. “The freight logistics industry in South Africa is dominated by road transport (trucks) and a very poor rail system,” says Professor Stephan Krygsman, subject head for transport economics at Stellenbosch University’s logistics department.

While the state is currently rolling out its National Infrastructure Plan of 2012, our roads are feeling the impact of increased traffic and heavy freight vehicles and the cost of maintaining and upgrading the infrastructure increases all the time. Coupled with often-inefficient operational management of infrastructure, this is an area of huge concern.

Conditions and labour

“Barloworld Logistics focuses on developing people and employing a diverse group of people with a full spectrum of the skills and mind-sets we need to stay ahead of the game. However, the attraction and retention of an evolving and vast array of skills remains a challenge to the industry,” says Stubbs.

The 2016 SA Logistics Barometer, compiled by Stellenbosch University, found that “in the past, South African supply chain managers and executives have had the required experience and know-how that enabled the industry to perform well in the global arena. Knowledge and understanding of key operational elements and the ability to adapt to an ever-changing environment has been a key strength of successful logistics and supply chain companies in South Africa for decades. The looming threat is that the future South African supply chain generation is at risk of losing this advantage due to sub-standard basic education, under-performing higher education, and lack of practical knowledge and skills transfer in the work environment.”

This, of course, is in addition to the general human resources and rigid labour laws faced by all businesses in South Africa.

Cost and competition

The 2016 SA Logistics Barometer concluded that “the country is… vulnerable to external shocks and logistics cost reduction needs to be a priority.” The biggest cost driver is transport followed by warehousing and carrying stock, which is affected by changes in the exchange rate.

Alison van den Berg, an attorney in private practice specialising in customs, excise law and disputes, says, “Companies I consult mention uncontrollable and excessive storage costs as risks facing their businesses. Industry associations are in discussions with authorities, but the issue remains unresolved.”

The ever-increasing fuel price is the most volatile and unpredictable element of the cost of running a logistics business. And the state of many of our roads and traffic congestion only add to the costs of running a vehicle, as do toll roads and e-tolling. Krygsman added, “you need (to clock up) very high kilometres per year to get your running costs low because the industry is very competitive. And this is where the industry is really tough: you need long-term contracts (four to seven years) to finance the vehicles and run a successful business. These contracts are based on personal relationships involving longstanding partnerships between the clients and the road freight operators. The more successful firms establish longer term contracts and are therefore able to withstand short-term market volatility”.

Development and change

Stubbs cautions against being a late adapter to technological advances in the industry. “The anticipation of the impact, and timing, of new technologies such as artificial intelligence and drones should challenge organisations to continuously question their business models and seize opportunities rather than being late adapters and getting left behind.”

Badenhorst-Weiss and Waugh summarised their findings as follows: “The factors identified as particularly problematic for the logistics industry, namely ineffective operational management of infrastructure, the general conditions in the labour market and increasing costs (to a greater or lesser extent) are outside the control of individual organisations and companies.

However, organisations can control how they react and mitigate these risk factors.”

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.