SA Mining

Platinum, Palladium And COVID-19: The Value Impact

By: Trevor Raymond, Director of Research at the World Platinum Investment Council (WPIC)

At first glance, working out what impact COVID-19 will have on the supply and demand of platinum and palladium should be quite a simple thing to do: how long the lockdown will last and what the impact will be on production, versus what has been the impact on demand.

In reality, however, it’s not. COVID-19 is one of a number of shifting plates that will impact the value of precious and industrial metals. The key is in understanding the impact of COVID-19 in this wider context.

But let’s start with COVID-19. Where should the prices of palladium and platinum end up after this unprecedented global economic shock, and why?

Supply/demand fundamentals are a good starting point (although sentiment and momentum are likely to dominate short-term price movement).

Here platinum is likely to benefit from the resurgence of gold as a risk hedge trading near decade high levels above $1 700/oz.

The high correlation between the prices of platinum and gold, associated with platinum’s precious credentials, is likely to provide upward momentum for platinum. Current extreme price movements also highlight that platinum remains undervalued compared to gold, itself and its sister platinum group metal palladium.

Investors and industrial users of platinum in China have already responded to the low platinum price with sales of platinum on the Shanghai Gold Exchange (SGE) up from an average of 171koz per quarter in 2019 to 455koz in Q1’2019.

WPIC product partners in Japan and the United States have confirmed a similar surge in consumer buying of platinum bars and coins.

Regarding demand, it may be tempting to estimate the decline in vehicle sales and attach that directly to the decline in automotive demand for platinum and palladium, which normally comprise 36% and 84% of total annual demand respectively.

And for supply, a simple reduction of mining output for the period of social distancing would appear appropriate.

However, before the COVID-19 pandemic the platinum and palladium markets were experiencing material changes in supply and demand that were unrelated to “normal” trends.

Automotive use of platinum and palladium is a huge factor in this equation, but this has less to do with a drop in demand for vehicles and more to do with legislation.

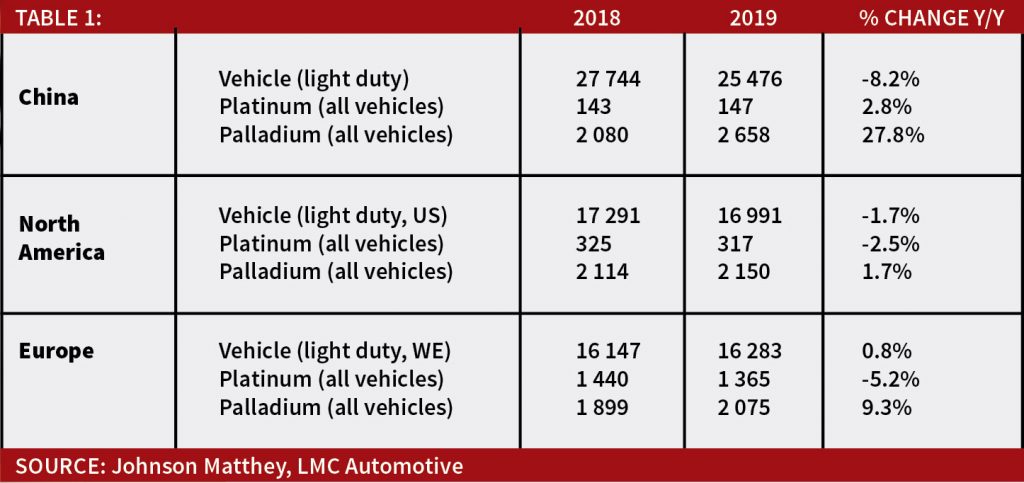

Table 1 shows the relative size of the light vehicle market and automotive use of platinum and palladium in China, North America and Europe.

The implementation of China 6 emissions regulations, now more stringent than those in Europe and the US, resulted in an increase in palladium use of 27% in 2019 despite 8% fewer vehicles manufactured compared to 2018.

This increase in loadings will remain in 2020 and more vehicles will comply with the new standard.

Palladium demand could remain higher in 2020 than in 2019 despite COVID-19 and as China has commenced its return towards full production and sales of its predominately gasoline (palladium dominant) passenger car fleet. Similarly, in Europe palladium demand increased in 2019 due to the higher loadings required by RDE (Euro 6d Temp with on-road testing) legislation. These higher loadings in China and Europe will offset demand loss in 2020.

Table 1 also shows the 5% decline in platinum demand in Europe in 2019 associated with fewer sales of diesel (platinum dominant) passenger vehicles.

This is a hangover from the Dieselgate NOx emissions crisis and out-of-favour diesel cars.

Paradoxically, an unexpected source of platinum demand may result in 2020, caused by the unprecedented negative fiscal impact on national governments due to the COVID-19 pandemic.

Funding of the power grid and charging infrastructure necessary to support the mass roll-out of battery electric vehicles (BEVs) may well be significantly restricted.

This could see increased importance in selling more diesel cars, which emit 20% to 35% less CO2 than their gasoline equivalents, and be essential in reducing climate change if BEV roll-out is slower.

It is unknown how long the disruption to vehicle production and sales will be in Europe and the US but even assuming a 20% loss of sales the palladium demand loss may not offset the palladium deficit expected (before the pandemic effects) in 2020.

Palladium’s price rise to $2 800/oz resulted from eight years of supply demand deficits and the fact that Chinese automakers buy metal in the spot market rather than using a hedged forward book, as is commonplace in the west.

During previous disconnects between the price of platinum and palladium, substitution of platinum for palladium balanced the two markets.

Understandably, automakers and autocatalyst manufacturers have not published details of substitution under way – its proprietary and confidential information and publication would increase the platinum price – but it is a process likely to continue during and after the pandemic.

The last shifting plate to consider is the sharp reduction in the supply of platinum and palladium that occurred in early March (pre-COVID-19 market turmoil).

Anglo American Platinum had sequential failures in its two converter plant units and is, as a result, currently unable to produce refined metal.

Repairs will take 80 days and will reduce its refined production in 2020 by 500koz of platinum and 300koz of palladium.

This information appeared to be glossed over by markets, specifically by traders on the NYMEX futures market.

Subsequently, South Africa imposed a three-week lockdown that suspended all mining (except coal for power generation).

This was extended to five weeks but a ramp-up allowing 50% of output has since commenced.

So, for investors, the picture is far from gloomy.

For palladium, dependent more heavily on loss of vehicle sales in the US and in tight supply in global terms, the previously expected deficit should move only towards balance.

However, physical buying in China is likely to drive a stronger price without speculative investment.

Meanwhile and somewhat counter-intuitively, the case for platinum now is more compelling than it was before the start of the pandemic.

Modelling the impact of a 20% loss of vehicle sales in 2020 shows that the platinum automotive demand loss is lower than the loss of supply from the Anglo Platinum converter outage.

Further platinum supply losses due to temporary COVID-19-related mine closures combined with increased investment demand and some substitution appear more likely to move platinum into a deficit than a surplus in 2020.

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.

Sign-up and receive the Business Media MAGS newsletter OR SA Mining newsletter straight to your inbox.